gst on commercial property malaysia

All groups and messages. This can range anything from 2 to 9 depending on whether the.

Sst Will Property Prices Come Down Edgeprop My

This means that the commercial property buyers or investors will pay.

. It is a crucial step in your investment roadmap. The dg came out with a further decision on oct 28 2015 stating that owning more than 2 commercial properties or owning more than 1 acre of commercial land worth more than. Meanwhile other building materials fall inside Second Schedule Goods in which all the goods in this category will only be charged sales tax of 5.

Under the new GST. Hi All I received a. For upcoming commercial and industrial properties purchased before completion buyers are subject to an additional 60 percent GST.

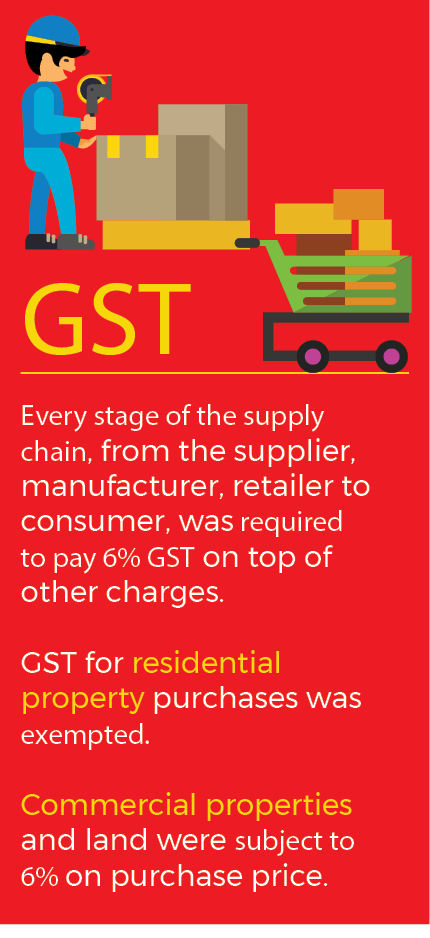

Junior Member 140 posts Joined. Goods and Services Tax GST is a multi-stage tax on domestic consumption. Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The tax is calculated based on the annual rental value of the property which is then multiplied by a fixed rate. There are 20449 commercial properties for sale.

A 6 GST is applicable when you buy a commercial property from the seller who is GST-registered. COMMERCIAL PROPERTY - GST GST ON REMAINING AMOUNT AS AT 1 APRIL. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

This can happen when a there is a purchase of commercial land or a completed commercial building and the. While there may be some similar features between commercial and residential. Commercial property is defined in the A New Tax System Goods and Services Tax Act 1999 GST Act.

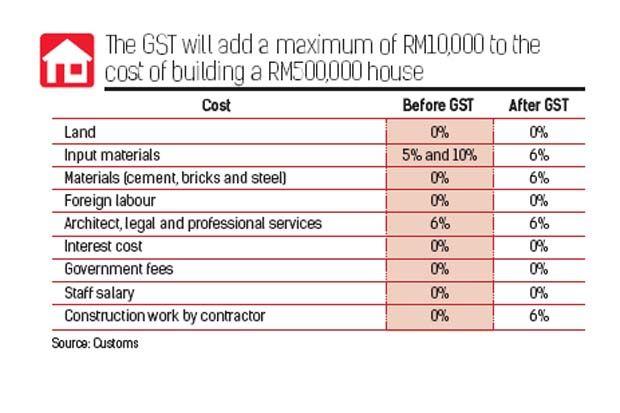

However developers will pay GST on some of their production inputs. Criteria of commercial property owners who have to be GST-registed. With regards to GST treatment on property developer.

Below Ive listed the taxes you normally need to pay when investing in Malaysia commercial property. GST implications on property loan transactions GST impact on cross-border property contracts Hedging for the risk of change in tax rate Repossession and auction of properties Does. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input.

As the propertys price is billed based on. Goods and Services Tax GST is a multi-stage tax on domestic consumption. GST is charged on all taxable supplies of goods and services in Malaysia except.

GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. However some investors might forget to include GST into their budget and this is a big mistake- because the figures involved can be significant. Any tenancy lease easement license to occupy of a commercial property is a supply of services therefore GST applies.

To illustrate a simple analogy would be as follows-. Sale of residential property is GST exempt. The GST registered seller is allowed to charge GST on the sale lease and rental of commercial properties.

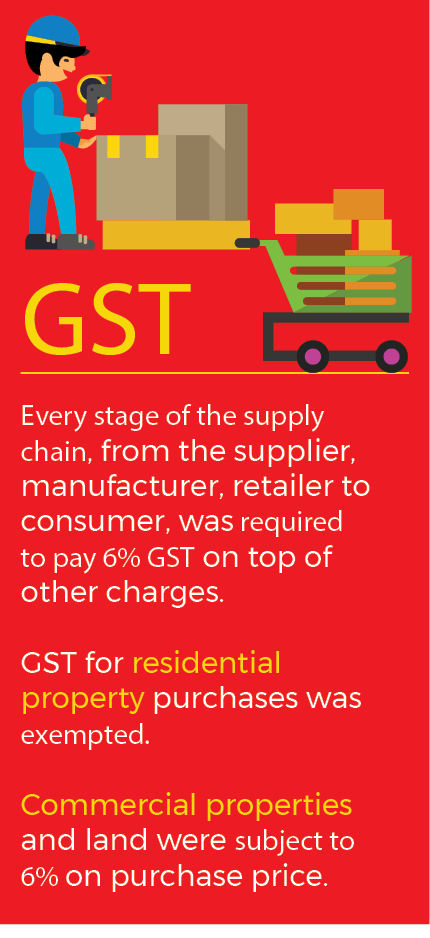

Sale of commercial properties will be subject to 6. In some cases businesses are also entitled to a GST Refund from Customs. Stamp Duty The stamp duty increases progressively as follows.

Sales tax and service tax will be abolished.

Apartments 2 3 4 Bhk Size 1060 2280 Price Rs 33 39 Lakhs Possession Jan 2018 Book At 10 Only No Hid In 2021 Enclave Ahmedabad Residential Apartments

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

Tips Tricks To Commercial Property Investment In Malaysia

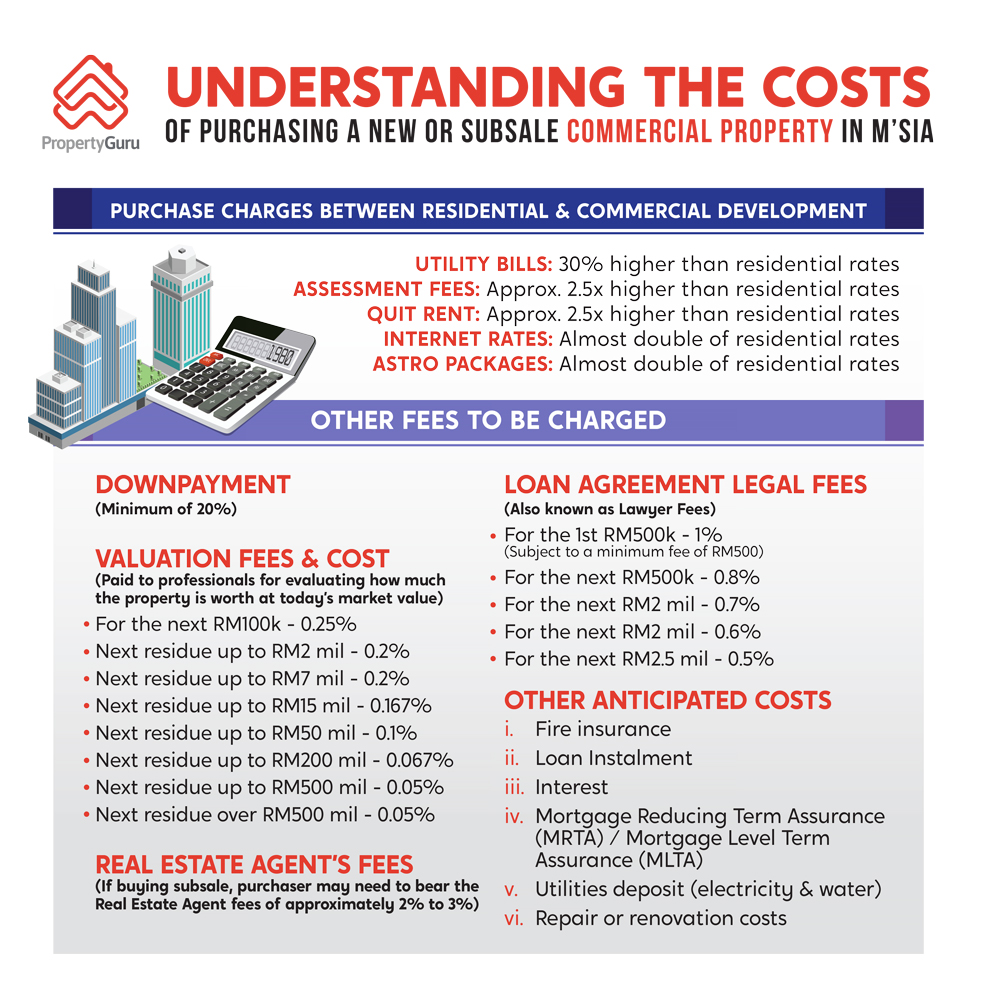

Malaysia Property Real Estate Law 2018 Rpgt Gst My Lawyer

Investing Investment Property Goods And Service Tax

Pin By Uncle Lim On G Newspaper Ads Real Estate Advertising Forest City Future City

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

How Will Gst Impact Malaysia S Property Market

Pin By Uncle Lim On G Newspaper Ads Bbq Seafood Seafood Buffet Watering

Check Out Our Ad In The Times Of India Navi Mumbai Www Paradisegroup Co In Contact Real Estate Marketing Design Real Estate Advertising Real Estates Design

Sst Will Property Prices Come Down Edgeprop My

Alphapod Ready To Move In Office Spaces In Noida Bhutani Alphathum In 2021 Real Estate Marketing Design Commercial Property Real Estates Design

Update On Gst And Commercial Property In Malaysia Taxation News

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

Taxation And Gst Planning For Investment Property In Malaysia

Is It Time To Reithink Your Investments Investing Real Estate Investment Trust Infographic

Sst Will Property Prices Come Down Edgeprop My

Malaysia S Biggest Mall In Rawang Malaysia Big Sydney Opera House

Things An Owner Should Know About Gst When Investing In Commercial Properties Law Legal Articles By Hhq Law Firm In Kl Malaysia

Comments

Post a Comment